Thursday, December 24, 2009

Saturday, November 14, 2009

A World Record for Manny Pacquiao

Manny Pacquiao hammers Miguel Cotto, of Puerto Rico, against the ropes during their WBO welterweight boxing title fight saturday November 14, 2009 at MGM Hotel, Las Vegas (AP Photo/Mark J. Terrill)

Manny Pacquiao hammers Miguel Cotto, of Puerto Rico, against the ropes during their WBO welterweight boxing title fight saturday November 14, 2009 at MGM Hotel, Las Vegas (AP Photo/Mark J. Terrill)

Sunday, October 11, 2009

Trading Accounts Update

I will keep you posted us usual.

Thursday, September 17, 2009

Doji Candle on Market Averages

Thursday, September 10, 2009

RBY and SJM Sold

I was planning to stay a bit longer with these long trades but I need to close my trading account which are at TD and Scottrade in order to meet my timetable. I will be opening a new one sometime next month. Have nice weekend!

I was planning to stay a bit longer with these long trades but I need to close my trading account which are at TD and Scottrade in order to meet my timetable. I will be opening a new one sometime next month. Have nice weekend! Wednesday, September 9, 2009

PBR Sold Near Resistance

Saturday, September 5, 2009

Baby Calista, Baby Mine

If your internet browsers are Internet Explorer or Google Chrome please use this link to view the slide show correctly, Baby mine, Baby Calista. Users of Mozilla Firefox should be fine. I hope you'll like it. Our friends in the USA, Happy Labor Day Weekend!

Long RBY

Rubicon Minerals Corporation (RBY) broke out of its base last Wednesday on good very high volume indicating bulls were in control. Thursday the stock printed a doji candle on its first day of pullback volume also shows buying support. This Friday RBY opened within the previous day level of around 3.60 its price action stayed above that level and managed to closed higher.

Rubicon Minerals Corporation (RBY) broke out of its base last Wednesday on good very high volume indicating bulls were in control. Thursday the stock printed a doji candle on its first day of pullback volume also shows buying support. This Friday RBY opened within the previous day level of around 3.60 its price action stayed above that level and managed to closed higher.Gold have been on tier recently and this company is following along. I also like the stock's three month long base and the heavy volume during breakout. Bought 700 shares at $3.74 commission fees included.

Happy Labor Day Weekend!

Thursday, September 3, 2009

PBR and SJM Long

The setup SJM is in an uptrend. The stock gaps up and filled the gap after four consecutive down bars. Then the stock trade sideways for another five days breaking thru the 10MA and 21EMA. Today a hammer was formed and close the day above the 34EMA. Notice that an uptrending trendline have also converged to meet the 34 EMA and the lows of the day. This is a bullish sign.

The setup SJM is in an uptrend. The stock gaps up and filled the gap after four consecutive down bars. Then the stock trade sideways for another five days breaking thru the 10MA and 21EMA. Today a hammer was formed and close the day above the 34EMA. Notice that an uptrending trendline have also converged to meet the 34 EMA and the lows of the day. This is a bullish sign.

The chart of PBR is extremely oversold. The candlestick yesterday is considered a COG (changing of the guard from Oliver Velez trading book) the price close the day in positive territory. Volume is also fine. A resistance around the 41 area will be tested soon price action today was not enough but it was able to close above its low on good trading volume. Bear has some strength left but its weakening.

Tuesday, September 1, 2009

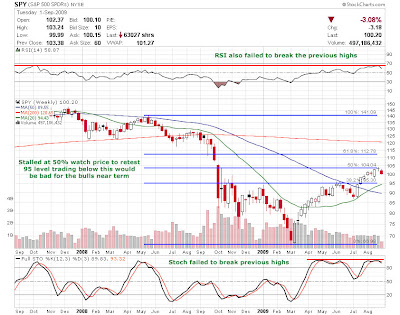

SPY chart

The chart of SPY does not look good for the bulls but its only one day so we will see how things develop. Trading volume was also heavy adding strength to the downward move. Other market ETFs were also in the same scenario.

Note to that SPY is having problem overcoming the 50% fib lines for a while and if price break below 100 and specially below 95 this will signals the bears are gaining momentum. I'll be watching these levels of support refer to the weekly chart below.

SDS closed

I sold my 100 shares of SDS this morning on the bounce at $45.36 price have been adjusted to include broker fees for a -$619.00 total loss. I was about to hold it one more night but I changed my mind I think selling it will give me a brand new slate. And if price move up tomorrow I can choose to buy SDS intraday dip. The best thing is that I'm free from any overnight uncertainty.

Saturday, August 15, 2009

Changes are coming

Rest assured that I will report my performance from last month to square off everything. BTW, I'm still holding SDS. I know market have been rippin' higher lately that's fine there are more of those to come. I'm staying in the sidelines for now.

Changes are coming to this blog. Details will soon follow. Have a nice weekend!

Friday, July 31, 2009

Day Trading

This month is a clear red ink as I've made poor picks, no concrete discipline, and weak trading management. Add to this my adventure to the option market have drown me more. I'm still holding my position on SDS this might be another big mistake in the making. Oh well...

Monday, July 27, 2009

Sold AAPL, 155AUG Put

Tuesday, July 21, 2009

Apple Quick Updates

SPY Softening

Monday, July 20, 2009

A blog for Persy

Please click this link "in memory of Persy So"

Shorting AAPL via Aug155 Put

Watching the Proxies

Friday, July 17, 2009

ARUN Trade Sold

Major indices are very near their respective resistance levels and price actions are flashing near term over bought condition. These are quite "textbook obvious" but be warned that it will not necessarily happen as you might expect. Give it time, observe how the market will play out next week. The thing to remember is that we, as a market player should be quick to adapt for any market changes and be able to adjust our game plan accordingly.

Enjoy your weekend!

Thursday, July 16, 2009

CAR Sold

Wednesday, July 15, 2009

CAR, Intraday to Swing Trade

Tuesday, July 14, 2009

Long ARUN

Sunday, July 12, 2009

Head and Shoulder on Major Markets

The QQQQ is now below the 50MA and the H&S neckline have been broken. The RSI, Stoch, and MACD are all pointing down. The slope of the 20MA is down.

The QQQQ is now below the 50MA and the H&S neckline have been broken. The RSI, Stoch, and MACD are all pointing down. The slope of the 20MA is down. The price on SPY is below the 50MA. The shorterm 20MA, blue line have crossed over to the 50MA and the H&S neckline have been broken. Trendlines on Stoch, and MACD are all pointing down.

The price on SPY is below the 50MA. The shorterm 20MA, blue line have crossed over to the 50MA and the H&S neckline have been broken. Trendlines on Stoch, and MACD are all pointing down. The 20MA, blue line on DIA have crossed over to the 50MA and the H&S neckline have been broken. Price is trading below the 50MA. Blue trendlines on Stoch, and MACD are all pointing down. However, the stochastic indicator on each of these ETFs are in the oversold level. Be extra careful tho the overall state of the market is weakening.

The 20MA, blue line on DIA have crossed over to the 50MA and the H&S neckline have been broken. Price is trading below the 50MA. Blue trendlines on Stoch, and MACD are all pointing down. However, the stochastic indicator on each of these ETFs are in the oversold level. Be extra careful tho the overall state of the market is weakening.Saturday, July 11, 2009

Performance: Month of June

Friday, July 10, 2009

We're Back...

Tuesday, June 23, 2009

Quick Update

Thursday, June 11, 2009

My Sister, My Friend, My Hero

Ate Persy, we love you very much. We will never forget you.

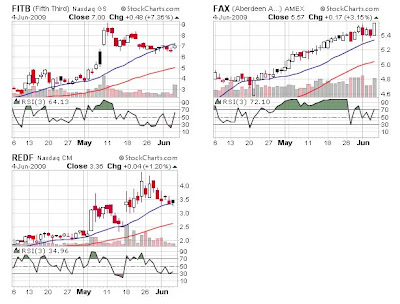

Sold REDF, FAX, and FITB

REDF, 300 shares for $3.45 for a net loss of -$56.00

FAX, 300 shares for $5.61 for a net gain of +$34.00

FITB, 300 shares for $7.70 for a net gain of +$178.00

I'm so thankful that I've managed to eke out some gains overall. Two of these trades REDF and FAX are problematic from the beginning due to entries being hit not according to my plan. I still have one position QQQQ, I'm trailing it with a stop.

Friday, June 5, 2009

Shooting Qs From The Hip

Still holding REDF, FITB and FAX.

Thursday, June 4, 2009

A Reply From Scottrade

Dear :

Thank you for your e-mail. We have reviewed the order in your *****0 account and determined that the order was filled appropriately. On 6/3/09, you submitted a buy stop order for 300 shares of REDF, with a stop price of $3.75, good for the day, at 01:00:19 ET (Order ID # XADED2E).

Please note that a stop order can be triggered if the Bid or Ask price reaches the stated stop price. It is not required that the security actually trade at the stated stop price for the order to trigger.

As shown in the Time & Sales detail below, REDF opened at 09:30:04 ET with an Ask price of $3.91. The opening Ask price triggered your stop order and it was routed to the market center as a Market buy order. The order was filled at the available price of $3.59 at that time.

Date Time X Volume Price VWAP Bid Bid ID Ask Ask ID Size Cond Corr# Seq#

06/03 09:30:51 K 300 3.59 3.5524

06/03 09:30:49

06/03 09:30:47

06/03 09:30:14

06/03 09:30:13

06/03 09:30:09

06/03 09:30:04

06/03 09:30:04

06/03 09:30:04 Q 110 3.45 3.4500

Please let us know if you have any questions.

Regards,

National Service Center, Scottrade Inc.

Wednesday, June 3, 2009

The Market Proxies

Disappointed with Scottrade

Hi,

Would you please send me an explanation about what have happened how my Buy Stop Order to buy REDF at $3.75 got triggered at $3.59?

The highest price was recorded at $3.61 according to your detailed price quote (reference time 8:55AM Pacific Time). I use “buy stop” because I do not have time to watch the screen and it is designed to help trader enter only on their target points.

Kindly, send me your explanation why and how this thing have happened and give me all the details. Thank you.

I really hope Scottrade will reply immediately and do something to correct this issue. I know I’m just a very small client but if this thing happens to me then most likely it may have happen to hundreds if not thousands of Scottrade clients.

Let me know if any of you have experience the same problem with this online broker.We should voice out this problem and demand every online brokers for an effective and prompt solution.

Tuesday, June 2, 2009

Stalking REDF

Update: Still holding my long position on FITB and FAX

Monday, June 1, 2009

Swing Trading FITB and the Scottrade issue on FAX

Sunday, May 31, 2009

Watchlist for Monday

THC - Buying on pullback at $3.45

FITB - Forming a bull flag, entry point is just above Friday's high at $7.00

FAX - Latest volume was good. I'll be buying long above Friday's high at $5.60

I don't have time to attach charts its already late, need to go to sleep. Good luck!

Saturday, May 30, 2009

Performance: Month of May

In the Sidelines

I'm in the process of tallying my trades for the month of May. I'll post it later on. Enjoy your weekend!

Tuesday, May 26, 2009

Buy to Cover APOL

Monday, May 25, 2009

LP Momo: Watchlist Week of May 26-29

Friday, May 22, 2009

APOL Short Update

Thursday, May 21, 2009

Sold LNET

Wednesday, May 20, 2009

Watching BDX for Short Ops

Existing Swing Trades LNET and APOL

Sold ADCT

Monday, May 18, 2009

Sold ODP

Shorted APOL

Buy to Cover ABT

Sunday, May 17, 2009

LP Momo: Short List for the Week of May 18 to 22

Saturday, May 16, 2009

The Illustrated Story of the Credit Crisis

Thursday, May 14, 2009

Changing of the Guard (COG)

Shorted ABT

Swing Trading ODP and ADCT

Wednesday, May 13, 2009

LP Momo Short List

Resistance Area

We are not sure how long this pullback will last so be careful let the market show its hands. The major indexes DJIA and SP-500 are below the 200 day moving average. The Nasdaq Composite has tried but failed to overcome that average. If the market can able to resume its up trend there will be a lot of set-up for low risk long trades.

For the now exercise patience and remember the big picture remains the same the overall market is still under a longer term down trend.