I've long learned that either way as an astute trader/investor the best way to deal with any market action is to be quick to adapt on any changes. Its always beneficial to avoid any form of biases. I find it much better to just observe and be ready for the coming opportunities. This way you will be faster to go with the market flow because your mind does not have any particular notions. You will find yourself agile. No open position at present.

Thursday, September 17, 2009

Doji Candle on Market Averages

The major market averages printed a doji today. Some even printed a longer top wick. Is this an omen of a high probability near term corrections? Maybe...Perhaps? Personally, I don't know we can guess or predict all we want but that's a futile exercise IMHO. I've done it before and it feels good from time to time. An ego booster. Something you brag to friends " I told you so..."

Thursday, September 10, 2009

RBY and SJM Sold

Sold 75 shares of SJM at $52.97 for a gain of +$109.00 including commission.

I was planning to stay a bit longer with these long trades but I need to close my trading account which are at TD and Scottrade in order to meet my timetable. I will be opening a new one sometime next month. Have nice weekend!

I was planning to stay a bit longer with these long trades but I need to close my trading account which are at TD and Scottrade in order to meet my timetable. I will be opening a new one sometime next month. Have nice weekend!

Sold 700 shares of RBY at $3.66 for a loss of -$55.00 including commission.

I was planning to stay a bit longer with these long trades but I need to close my trading account which are at TD and Scottrade in order to meet my timetable. I will be opening a new one sometime next month. Have nice weekend!

I was planning to stay a bit longer with these long trades but I need to close my trading account which are at TD and Scottrade in order to meet my timetable. I will be opening a new one sometime next month. Have nice weekend! Wednesday, September 9, 2009

PBR Sold Near Resistance

Saturday, September 5, 2009

Baby Calista, Baby Mine

Here is a collection of photos made into a beautiful slide show by Evelyn for baby Calista. Background music was from a song entitled "Baby Mine" by Allison Krauss.

If your internet browsers are Internet Explorer or Google Chrome please use this link to view the slide show correctly, Baby mine, Baby Calista. Users of Mozilla Firefox should be fine. I hope you'll like it. Our friends in the USA, Happy Labor Day Weekend!

If your internet browsers are Internet Explorer or Google Chrome please use this link to view the slide show correctly, Baby mine, Baby Calista. Users of Mozilla Firefox should be fine. I hope you'll like it. Our friends in the USA, Happy Labor Day Weekend!

Long RBY

Rubicon Minerals Corporation (RBY) broke out of its base last Wednesday on good very high volume indicating bulls were in control. Thursday the stock printed a doji candle on its first day of pullback volume also shows buying support. This Friday RBY opened within the previous day level of around 3.60 its price action stayed above that level and managed to closed higher.

Rubicon Minerals Corporation (RBY) broke out of its base last Wednesday on good very high volume indicating bulls were in control. Thursday the stock printed a doji candle on its first day of pullback volume also shows buying support. This Friday RBY opened within the previous day level of around 3.60 its price action stayed above that level and managed to closed higher.Gold have been on tier recently and this company is following along. I also like the stock's three month long base and the heavy volume during breakout. Bought 700 shares at $3.74 commission fees included.

Happy Labor Day Weekend!

Thursday, September 3, 2009

PBR and SJM Long

The setup SJM is in an uptrend. The stock gaps up and filled the gap after four consecutive down bars. Then the stock trade sideways for another five days breaking thru the 10MA and 21EMA. Today a hammer was formed and close the day above the 34EMA. Notice that an uptrending trendline have also converged to meet the 34 EMA and the lows of the day. This is a bullish sign.

The setup SJM is in an uptrend. The stock gaps up and filled the gap after four consecutive down bars. Then the stock trade sideways for another five days breaking thru the 10MA and 21EMA. Today a hammer was formed and close the day above the 34EMA. Notice that an uptrending trendline have also converged to meet the 34 EMA and the lows of the day. This is a bullish sign.Bought 75 shares of SJM for $51.51 including commission. Stop at $50.46

The chart of PBR is extremely oversold. The candlestick yesterday is considered a COG (changing of the guard from Oliver Velez trading book) the price close the day in positive territory. Volume is also fine. A resistance around the 41 area will be tested soon price action today was not enough but it was able to close above its low on good trading volume. Bear has some strength left but its weakening.

Bought 100 shares of PBR yesterday at $40.04 commission included. Stop at $38.61

Tuesday, September 1, 2009

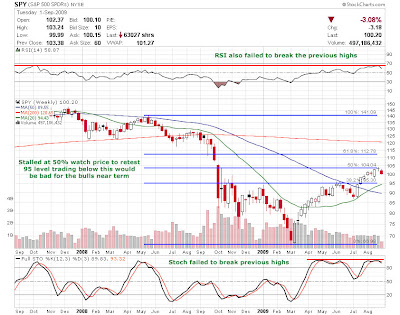

SPY chart

The chart of SPY does not look good for the bulls but its only one day so we will see how things develop. Trading volume was also heavy adding strength to the downward move. Other market ETFs were also in the same scenario.

Note to that SPY is having problem overcoming the 50% fib lines for a while and if price break below 100 and specially below 95 this will signals the bears are gaining momentum. I'll be watching these levels of support refer to the weekly chart below.

SDS closed

This trade have shown my biggest trading mistake "not selling immediately when proven wrong" I was stubborn and refuse to take my losses. The same thing happened with my AAPL put position these trades showed my lack of discipline and a not following my trade plan. The result is devastating almost 100% of my gains since April have been evaporated. A very expensive lesson that should not be repeated at all cost!

I sold my 100 shares of SDS this morning on the bounce at $45.36 price have been adjusted to include broker fees for a -$619.00 total loss. I was about to hold it one more night but I changed my mind I think selling it will give me a brand new slate. And if price move up tomorrow I can choose to buy SDS intraday dip. The best thing is that I'm free from any overnight uncertainty.

I sold my 100 shares of SDS this morning on the bounce at $45.36 price have been adjusted to include broker fees for a -$619.00 total loss. I was about to hold it one more night but I changed my mind I think selling it will give me a brand new slate. And if price move up tomorrow I can choose to buy SDS intraday dip. The best thing is that I'm free from any overnight uncertainty.

Subscribe to:

Posts (Atom)